If you’ve never bought or run a HMO before, it can be difficult to know if it’s a good investment

In this post I will outline why investing in a HMO is an excellent way to get a great return, if you know what you’re doing

But beware, it can also go horribly wrong. Allow me to explain.

What I’ll Cover

But First, Why Listen to Me?

We started out as a completely hands-off property investors. But our portfolio was mis-managed by an agent and we were at risk of losing it all. We took the properties back, learnt everything and turned it around. That tough process resulted in us becoming experts at creating, managing and optimising HMOs.

Since then, I (Rob) took on another landlord’s problem properties. Armed with the knowledge of turning a failing portfolio around, I knew what to do and got all 8 properties back on track and turning a profit.

I now own and/or manage a portfolio worth £3.5 million with over 50 letable units and have a proven track record of making HMOs work exceptionally well.

How Much Money do I need to Invest in a HMO?

Using my preferred strategy, which is a lower risk option (Low Upfront Cost below), you can get started with around £70-80,000. That will produce a healthy 15% return and give you good property price growth in the future.

Can You Invest in a HMO with No Money?

Some people are looking for no money down options to get started in property. You’ll see lots of people on YouTube, Instagram and TikTok showing you how you can do this, but be warned. It’s not as easy as they would have you think. And no matter what approach you take, be it rent to rent or some other no or low money down option, you need some cash reserves.

Rent-to-rent: This is where you rent a property from a landlord and guarantee them a fixed price per month. You then rent out each room and run it as a HMO. Profit margins are often tight when you factor in all costs.

There are lots of factors which will change how much money you need to get started. I can give you an example of exactly how I do most of my HMO investing so you can see real world examples. Please note that every deal is different, depending on the property layout, condition and what work is required.

HMO Investment Strategy (Low Upfront Cost)

With this strategy, the aim is to invest in a HMO with as little capital as possible to generate the best returns. Here are some key points for this approach:

- No structural changes such as loft conversions and extensions

- No en-suite rooms, unless the property already has them

- Building of stud walls to partition rooms might be required

- Usually a maximum of 5 people per house

- New fire doors, alarm system, furniture, and usually consumer unit (fuseboard)

- Might need a bit of painting and some new carpets

- Kitchen and bathroom need to be good enough to use without changing them

How to Find a Suitable Property

- 3-bed properties work well, converting the downstairs living room into bedrooms

- Must have a large enough open plan kitchen/dining area

- Stairs should not come down into the kitchen/dining area

- Must have a main bathroom and additional, separate (usually downstairs) toilet

- Flats almost never work for this strategy

- Minimum size is 90m2 or more

How to Know What to look for?

I can tell you straight away by looking at a floor plan if a property can work with this strategy because I have used this approach many times before. I have an excellent working relationship with the local council and can get pre-approval for any HMO before I do any work or purchase a property. This comes with experience.

The critical point is to make sure you know all the rules and regulations. Once you know them all, and you’ve seen them first hand, you’ll know what can work and what doesn’t.

HMOs and Licensing: A HMO is defined as 3 or more people from 2 or more households (meaning they are not related). Mandatory licencing is required for 5 or more people, but some areas require it for 3 or more people. Always check with your local council on this as it is up to them how the licensing works.

Example Figures

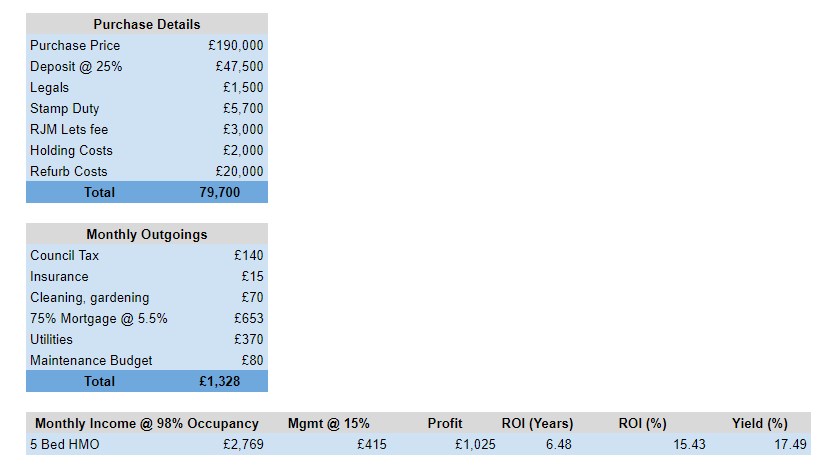

Let’s take a property that costs £190,000 and see how the numbers look

Example HMO profit figures

Let’s take a more detailed look at the figures and what they mean:

Purchase Details

- Purchase Price: £190,000 for a 3 bed terraced house

- Deposit 25%: Usual amount to put down but other options are available at the cost of a higher interest rate

- Legals: Approx cost for a solicitor to complete the purchase

- RJM Lets Fee: The fee I charge to do every part of the process from finding the right property to getting it HMO ready and signed off by the council

- Holding Costs: Paying for the mortgage, council tax, utilities, etc while the property is being worked on

- Refurb Costs: Approx cost for fire doors, all furnishings, fire alarm system, electrical work, and other work such as painting

Monthly Outgoings

- Council Tax: Normal rate for the area and house a a whole, not per room

- Insurance: Building only insurance

- Cleaning, gardening: Regular cleaner and semi-regular gardener if required

- Mortgage: This is using a 5.5% interest rate, but this can change depending on what deals are available

- Utilities: Approx cost for gas, electric, water and WiFi per month averaged over the year

- Maintenance Budget: This shouldn’t be high as with a new HMO most work would have been completed as part of the refurb

Monthly Income

- Rental Income: I use a 98% occupancy rate based on how well all my others rent out. We’re at 100% most of the time with almost no voids

- Management: I charge a flat rate of 15% management fee. No additional costs for tenants moving in or out. The only additional charge is full referencing per tenant

- Profit: How much you, as the investor, would make per month before tax

- ROI (Years): How long it would take you to get your initial investment back. In this case, £79,700

- ROI (%): Your annual return on investment as a percentage based on gross monthly profit

- Yield (%): Just for reference to compare against other investment options. This is the gross rental income over the year, divided by the purchase price

Note: Capital appreciation of the asset has not been included. Meaning, there is likely to be an increase in value in the property over the years you own it. That will improve your return on investment, but seeing no one knows the increase I do not estimate it or include it in the figures.

In answer to the question what kind of return can I get from a HMO, my answer would be around 15%

Other Factors

As with everything in life, lots of factors will determine how this all works. The big ones are:

- Location – This determines how much you can charge for a room, labour costs for refurbishment, purchase price and capital appreciation

- Rooms – The layout of your property will determine how many rooms you can have. Ideally, you want between 5 and 6. If only 4, you often don’t make enough to make it worthwhile.

- Refurb – Usually, to keep costs down, you want to find a property which isn’t in the best condition but doesn’t require structural changes. A lick of paint, changing the doors and laying new carpet make a world of difference to how a place looks and don’t cost a lot. If you have to start ripping out kitchens, bathrooms, making structural changes and re-plastering then costs quickly add up

Investment Time: HMO property investment is not usually a quick in and out game. You need to be in it for the medium to long term to make it cost-effective. A minimum of 5 years I would suggest, but ideally 10+ years to see the best returns. It’s an excellent income generator.

HMO Investment Strategy (High Upfront Cost)

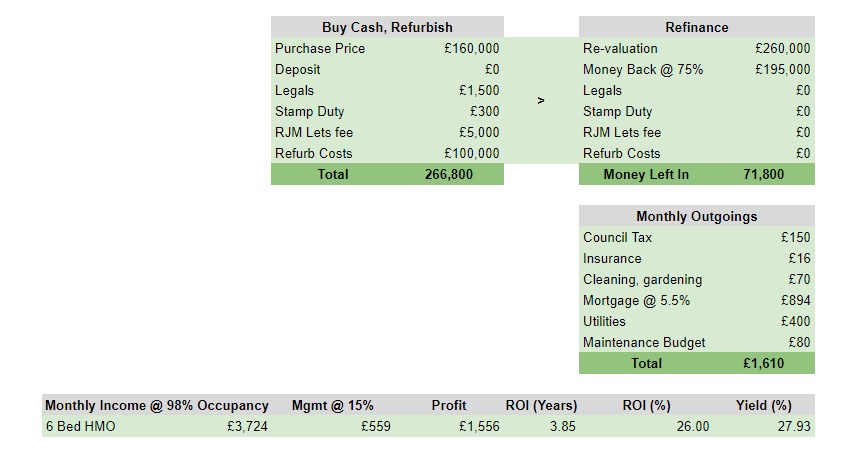

There is another way to do things when looking at investment options for converting a residential house into a HMO. This is more of a Buy, Refurbish, Refinance (BRR) approach.

The aim here is to find a property that really needs work doing to it. A run down place, so you get it for a run down price!

You need to be able to buy it fully in cash. You then do whatever work you want to with it. This is usually a bigger project, including extensions and loft conversions. Everything will be new, so kitchen, bathroom, perhaps some en-suite bedrooms.

BRR: Buy, Refurbish, Refinance is the holy grail of property investing when you can get all of your money back after re-financing. This means you can rinse and repeat your cash repeatedly and grow your portfolio quickly. These kinds of deals are hard to find!

Note: You need the full amount in cash for everything, so in the example below that is £266,800. You can also do this using a bridging loan but it eats into your profit massively.

When doing this, you really have the opportunity to add value. And that’s the best part about this strategy. You aim to buy low, add value, then refinance to pull your money out. Let’s look at an example:

Example HMO refurb and profit figures

Buy Cash, Refurbish

Purchase Price: How much you buy it for. You need to know the market really well to know if you are getting a good deal. Local knowledge is incredibly important. Sometimes you can go just 3 streets away and property prices differ significantly. You have to be 100% sure you are getting a great deal for this strategy to be effective

- Deposit: No deposit because you’re buying the property in full

- Legals & Stamp Duty (SDLT): You still have these costs

- RJM Lets Fee: Lots more involved in this one so a higher fee, but still a completely hands-off investment for the investor and I take care of everything from start to finish

- Refurb Costs: This is just an idea, because it depends on what the plan is. Adding an extension to create a 6th bedroom for example, will be around £40,000. For 6 people, the regulations change so you need additional facilities in the kitchen plus other areas. I’ve put down £100,000 but it could be higher or lower. All of these figures would be done more accurately for a specific project.

Refinance

The aim of this part is to get the highest valuation possible. Most times, if you still have what would be described as a normal (ish) family home you will only get a family home valuation. If, however, you have created something that would never be used like a family home then you might go for a commercial valuation.

What’s an example? Well, imagine you have a 6 bed HMO. There is the main bathroom and two of the rooms have en-suites. You really just have a family home that you are renting out by the room. But if you had a 6 bed HMO with an en-suite in every room, 2 x hobs and other features in the layout which made is unlike a family home, you are more likely to achieve a commercial valuation.

Commercial valuation: A different way of a lender valuing how much your property is worth. Usually it is a multiplier of the rental income. Let’s say you have a gross rental income of £4,000 per month, which is £48,000 per year. The multiplier might be 10 so you get a valuation of £480,000. With a standard “bricks and mortar” valuation being perhaps lower when compared to other 6 bedroom properties in the area.

Re-valuation: This is what a the lender will lend against. We bought it for £160,000 and spent £100,000 so for this example I have put down the re-valuation as the sum of both. Ideally, you want it to be higher than your purchase price + refurb cost.

Money back at 75%: The amount that the lender will give you

Legals: I put none, but there might be some. It will depend on if the lender includes those with their product or not.

Stamp Duty, Fees and Refurb: All of those were paid already

When you look at what you spent (£266,800) minus what you got back (£195,000), you left £71,800 in the deal.

Monthly Outgoings

Here you have all of the same categories of expense as in the previous example, just that the mortgage is a bit higher because you are borrowing more money. You wouldn’t expect the utilities to be too much higher because you get economies of scale with facilities like using the gas central heating.

Monthly Income

As you can see, we have now converted this to a 6 bed HMO so we have extra income. That has boosted the income significantly, and also means that the Return on Investment (ROI) figure is a lot higher.

Conclusion

So there you have it. Two main strategies for maximising your return on investment when creating a HMO.

I specialise in doing these projects and have done a lot of the first type, so I know what works and what doesn’t. If you are interested in finding out more about how you could invest in property, and specifically HMOs, feel free to get in touch for an informal chat.